The ordinary shares of Ecofin Global Utilities and Infrastructure Trust plc (the ‘Company’ or ‘EGL’) began trading on the London Stock Exchange on 26 September 2016. The Company’s assets are primarily invested in equity and equity-related securities of utility and infrastructure companies in developed countries. These companies have a mix of regulated and growth-oriented business segments:

Ecofin Global Utilities and Infrastructure Trust plc is an investment company domiciled in the United Kingdom. Its ordinary shares are listed on the London Stock Exchange (EGL:LN). As an investment trust, the Company is exempt from capital gains tax and its shares are eligible for inclusion in an Individual Savings Account.

Fund Stats as of 24/07/2024:

NAV per Share (pence)

204.96

Share Price (pence)

182.25

Premium/Discount

-11.08%

Dividend Yield

4.39%

Total Net Assets

£220,989,390

Gearing (% of net assets)

12.90%

Issued Share Capital

110,625,598

SEDOL

BD3V464

ISIN

GB00BD3V4641

Electric & gas utilities

Generation, transmission & distribution of electricity, gas and liquid fuels and renewable energies

Transportation services

Roads, railways, ports and airports

Water & environment

Water supply, wastewater, water treatment and environmental services

The latest from EGL

Sectors set for profitable growth

There is a requirement for substantially greater investment in economic infrastructure globally in order to support economic growth and to meet the UN’s Sustainable Development Goals. Corporate strategies are changing rapidly in the Company’s sectors to meet the urgent demands for more and cleaner electricity and for the mitigation of environmental risks. Capital spending requirements related to the modernisation of inadequate infrastructure and to the transition to low and zero carbon energies should support profitable growth for the Company’s investment universe and portfolio.

Investment objective and policy

Ecofin Global Utilities and Infrastructure Trust plc's investment objectives are to achieve a high, secure dividend yield on its investment portfolio and to realise long-term growth in the capital value of its portfolio for the benefit of shareholders, while taking care to preserve shareholders’ capital.

The Company may make use of gearing to enable it to earn a high level of dividend income and to offer shareholders a geared return on their investment. The Directors of the Company believe that the use of gearing is justified given the nature of most of the companies in which the Company invests; that is, companies which provide essential services, operate in regulated markets and within stable regulatory frameworks, and pay dividends. The Company utilises a flexible gearing policy with the ability to borrow amounts up to 25% of net assets.

The Company is registered in England & Wales with Registered Number 10253041.

Ecofin Global Utilities and Infrastructure Trust plc EGL.LN

Latest Announcements

Literature Archive

Annual and Interim Reports

Portfolio Updates

- EGL Portfolio Update Jan 2023

- EGL Portfolio Update February 2023

- EGL Portfolio Update March 2023

- EGL Portfolio Update April 2023

- EGL Portfolio Update May 2023

- EGL Portfolio Update June 2023

- EGL Portfolio Update July 2023

- EGL Portfolio Update August 2023

- EGL Portfolio Update September 2023

- EGL Portfolio Update October 2023

- EGL Portfolio Update November 2023

- EGL Portfolio Update December 2023

- EGL Portfolio Update January 2022

- EGL Portfolio Update February 2022

- EGL Portfolio Update March 2022

- EGL Portfolio Update April 2022

- EGL Portfolio Update May 2022

- EGL Portfolio Update June 2022

- EGL Portfolio Update July 2022

- EGL Portfolio Update August 2022

- EGL Portfolio Update September 2022

- EGL Portfolio Update October 2022

- EGL Portfolio Update November 2022

- EGL Portfolio Update December 2022

- EGL Portfolio Update January

- EGL Portfolio Update February

- EGL Portfolio Update March

- EGL Portfolio Update April

- EGL Portfolio Update May

- EGL Portfolio Update June

- EGL Portfolio Update July

- EGL Portfolio Update August

- EGL Portfolio Update September

- EGL Portfolio Update October

- EGL Portfolio Update November

- EGL Portfolio Update December

- EGL Portfolio Update January

- EGL Portfolio Update February

- EGL Portfolio Update March

- EGL Portfolio Update April

- EGL Portfolio Update May

- EGL Portfolio Update June

- EGL Portfolio Update July

- EGL Portfolio Update August

- EGL Portfolio Update September

- EGL Portfolio Update October

- EGL Portfolio Update November

- EGL Portfolio Update December

- Ecofin Global December 2018

- Ecofin Global November 2018

- Ecofin Global October 2018

- Ecofin Global September 2018

- Ecofin Global August 2018

- Ecofin Global July 2018

- Ecofin Global June 2018

- Ecofin Global May 2018

- Ecofin Global April 2018

- Ecofin Global March 2018

- Ecofin Global February 2018

- Ecofin Global January 2018

Allocations

As of 30/06/2024

10 Largest holdings

| Company | % of Total | |

|---|---|---|

National Grid | 6.3% | United Kingdom |

NextEra Energy | 6.2% | United States |

American Electric Power | 4.2% | United States |

SSE | 4.1% | United Kingdom |

Enel | 4.0% | Italy |

| Company | % of Total | |

|---|---|---|

RWE | 3.6% | Germany |

Edison Int'l | 3.6% | United States |

ENAV | 3.5% | Italy |

Constellation Energy | 3.4% | United States |

E.ON | 3.3% | Germany |

Total: 42.2%

| all total returns in £ | 1 Month | 3 Month | 6 Month | 1 Year | 3 Year | 5 year | Since Inception 1 |

|---|---|---|---|---|---|---|---|

| Net Asset Value | -5.5% | 2.8% | 5.3% | 1.8% | 20.1% | 50.7% | 94.3% |

| Share Price | -3.6% | 8.2% | 4.3% | -1.3% | 11.2% | 51.7% | 118.8% |

| S&P Global Infrastructure Index | -2.3% | 2.3% | 4.4% | 6.6% | 25.3% | 19.3% | 47.3% |

| MSCI World Utilities Index | -4.2% | 3.0% | 5.5% | 5.4% | 20.0% | 25.4% | 58.8% |

| MSCI World Index | 2.8% | 2.6% | 13.1% | 21.4% | 35.1% | 79.5% | 147.4% |

| FTSE All-Share Index | -1.1% | 3.7% | 7.4% | 12.8% | 23.4% | 30.4% | 56.4% |

| FTSE ASX Utilities | 2.5% | -0.6% | -4.3% | 0.6% | 28.5% | 64.8% | 38.2% |

-

26 September, 2016

Source: Bloomberg. Performance is shown on a total return basis, i.e., assuming reinvestment of dividends.

The board of directors are all non-executive and independent. Apart from Max King, Susannah Nicklin and Joanna Santinon, the directors were appointed at admission on 26 September, 2016. All directors are members of the Audit Committee, Management Engagement Committee and Remuneration Committee.

David Simpson

Chairman

David Simpson, the chairman of the Company, is a qualified solicitor and was a partner at KPMG for 15 years until 2013, culminating as global head of M&A. Before that he spent 15 years in investment banking, latterly at Barclays de Zoete Wedd Ltd. He is chairman of M&G Credit Income Investment Trust plc, and a director of Aberdeen New India Investment Trust PLC and ITC Limited, a major listed Indian company.

Malcolm (Max) King

Chairman of the Remuneration Committee

Max King is a chartered accountant and has over 30 years’ experience in fund management having worked at Finsbury Asset Management, J O Hambro Capital Management and Investec Asset Management. He is also a columnist for MoneyWeek magazine. Max is currently a director of Gore Street Energy Storage Fund plc. He was appointed as a director of the Company on 11 September 2017.

Susannah Nicklin

Senior Independent Director

Susannah Nicklin is an experienced non-executive director and financial services professional with 25 years of experience in executive roles in investment banking, equity research and wealth management at Goldman Sachs and Alliance Bernstein in the US, Australia and the UK. Susannah is Chair of the Schroder BSC Social Impact Trust plc and a non-executive director of Baronsmead Venture Trust plc, The North American Income Trust plc and Frog Capital LLC. She holds the Chartered Financial Analyst qualification. She was appointed as a director of the Company on 9 September 2020.

Joanna Santinon

Chairman of the Audit Committee

Joanna Santinon is a chartered accountant and chartered tax adviser. She specialised in tax, transactions and private equity, and gained wider experience including mergers and acquisitions, strategic investments, capital raisings and listings in her 24 year career at EY. Joanna was a founder member of the 30% Club in the UK. She is a non-executive director and audit committee chair of Octopus Future Generations VCT plc and of Guinness VCT plc. She is also a trustee of The Centre For Entrepreneurs. She was appointed as a director of the Company on 12 September 2023.

Company Secretary and Registered Office

Company Secretary and Registered Office

Apex Fund Administration Services (UK) Limited

Hamilton Centre

Rodney Way

Chelmsford CM1 3BY

Tel: 01245 950317

Email: cosec@maitlandgroup.com

-

Administrator

BNP Paribas Securities Services S.C.A.

10 Harewood Avenue

London NW1 6AA -

Broker

Stifel Nicolaus Europe Limited

150 Cheapside

London EC2V 6ET -

Investment Manager

-

Banker, Custodian and Depositary

Citigroup

Citigroup Centre

Canada Square, Canary Wharf

London E14 5LB -

Solicitor

Norton Rose Fulbright LLP

3 More London Riverside

London SE1 2AQ -

Registered Auditor

BDO LLP

55 Baker Street

London W1U 7EU -

Registrar

Computershare Investor Services PLC

The Pavilions, Bridgwater Road, Bristol

BS99 6ZZ, United Kingdom

Telephone for enquiries: +44 (0)370 703 6234

www.investorcentre.co.uk

The share register for Ecofin Global Utilities and Infrastructure Trust plc is maintained by Computershare Investor Services. If you have a problem – such as a lost documentation or dividend cheque – please contact Computershare Investor Services directly. Your account details may also be accessed by using their website.

Computershare Investor Services PLC

The Pavilions, Bridgwater Road, Bristol

BS99 6ZZ, United Kingdom

Telephone for enquiries: +44 (0)370 703 6234

Financial Calendar

| Dividends payable (last business day of) | February, May, August, November |

| AGM | March |

| Half-year ends | 31 March |

| Release of Interim Report | May |

| Financial year ends | 30 September |

| Release of Annual Report | December |

Regulatory Documents

- Ecofin Global Utilities and Infrastructure Trust plc - Key Information Document (KID) July 2021

- EGL Alternative Investment Fund Manager Directive Fund Disclosures (Updated March 2021)

- EGL Annual General Meeting 09 March 2021 – Investment Manager’s Presentation

- EGL Annual General Meeting 09 March 2021 – Summary of Proxy Votes

- Ecofin Global Utilities And Infrastructure Trust Plc Prospectus 6 July 2016

- Ecofin Global Utilities And Infrastructure Trust Plc AIFMD Investor Disclosures

- EGL Supplementary Prospectus 22 August 2016

- Ecofin Global Utilities and Infrastructure Trust plc – First Day of Dealings

- Ecofin Global Utilities and Infrastructure Trust plc – Initial Portfolio and Indicative NAV

- Ecofin Global Utilities And Infrastructure Trust Plc Quarterly Dividend

Research Reports

- Ecofin Global Utilities and Infrastructure Trust plc - Marten & Co Research Report June 2024

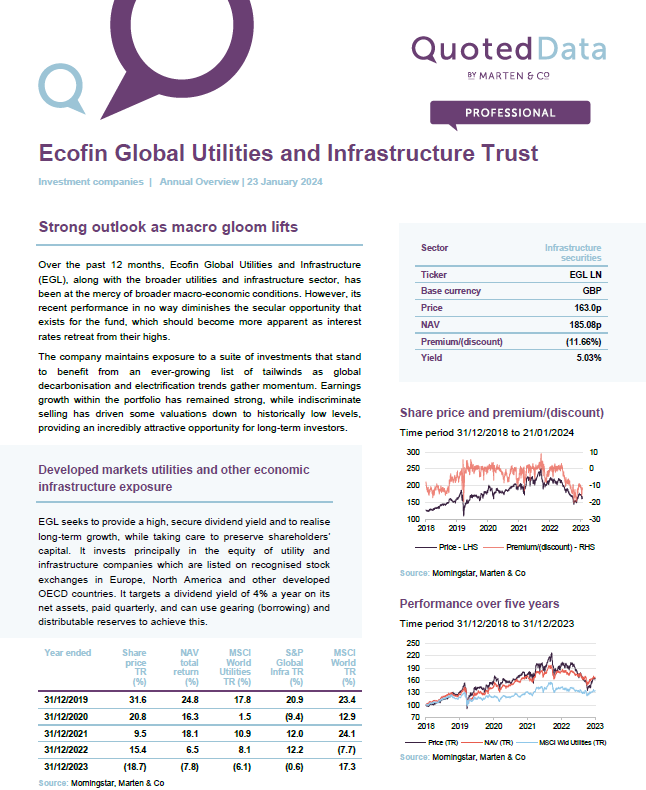

- Ecofin Global Utilities and Infrastructure Trust plc - Marten & Co Annual Overview Report January 2024

- Ecofin Global Utilities and Infrastructure Trust plc - Marten & Co Research Report August 2023

- Ecofin Global Utilities and Infrastructure Trust plc - Marten & Co Research Report November 2022

- Ecofin Global Utilities and Infrastructure Trust plc - Marten & Co Research Report October 2021

- Ecofin Global Utilities and Infrastructure Trust plc - Marten & Co Research Report May 2021

- Ecofin Global Utilities and Infrastructure Trust plc - Marten & Co Research Report December 2020

- Ecofin Global Utilities and Infrastructure Trust plc - Marten & Co Research Report June 2020

- Ecofin Global Utilities and Infrastructure Trust plc - Marten & Co Research Report October 2019

- Ecofin Global Utilities and Infrastructure Trust plc - Marten & Co Research Report April 2019

- Ecofin Global Utilities and Infrastructure Trust plc - Marten & Co Research Report October 2018

- Ecofin Global Utilities and Infrastructure Trust plc - Marten & Co Research Report March 2018

- Ecofin Global Utilities and Infrastructure Trust plc - Marten & Co Research Report November 2017

- Ecofin Global Utilities and Infrastructure Trust plc - Quoted Data Research Report November 2017

- Ecofin Global Utilities and Infrastructure Trust plc – Quoted Data Research Report May 2017

- Ecofin Global Utilities and Infrastructure Trust plc - Marten & Co Research Report May 2017